Embed this model in a webpage:

Link to this model:

Link to this model and its source:

Investigate this model further by visiting its Open Source Physics webpage.

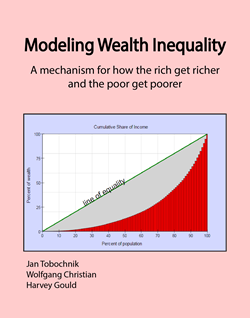

Do the rich get richer and the poor get poorer? We investigate this saying using a simple easy to build "toy" economy known as the Asset Exchange Model or the Yard Sale Model . The model consists of N buyers and sellers, known as agents, who spend their time buying and selling goods at a yard sale. In this economic model, two agents A and B are chosen at random and goods are exchanged. If the price of the item is correct, neither agent gains or looses wealth but this is uninteresting and unrealistic. In a realistic transaction an agent can either pay too much or get a bargain so that one agent becomes slightly richer while the other agent becomes poorer. What happens to the wealth of agent if this process is repeated many times and if we assume that the agent receiving the bargain is chosen at random so that sometimes agent A gains and sometimes agent A looses in the transaction. In other words, neither agent is always shrewd or always gullible so that all agents have an equal chance of getting rich. Does this model produce an equitable distribution of wealth?

To keep our model simple, we assume that each agent begins with equal wealth and that during an interaction the two agents A and B exchange a fraction f of the smaller wealth.

Note that agents cannot go into debt in this model because the wealth exchanged is

always less than the wealth of the poorer agent and that the total wealth of the system

remains constant because one agent gains wealth while the other agent looses wealth. The

natural time unit (timestep) in an N agent economy consists of N random transactions so that

each agent participates in approximately one transaction during each timestep.

The goal of the models we will discuss is not to reproduce the specifics of particular societies, but to provide insight into their general behavior. The beauty of the model is how little is needed to produce results that help us understand why wealth inequality occurs. The model consists of many exchanges of wealth between two agents chosen at random. The key assumption is that the wealth exchanged between the two agents is a percentage of the wealth of the poorer agent.

Note: The Asset Exchange Model simulations on this website are also available in an electronic book Modeling Wealth Inequality: A mechanism for how the rich get richer and the poor get poorer by Jan Tobochnik, Wolfgang Christian, and Harvey Gould. This book requires an ePub 3 reader and is available from iTunes and other online stores.

The model can be described by the following computational steps (or algorithm).

Specify the number of agents and give them each a certain amount of initial wealth.

Choose two agents at random regardless of their wealth.

Determine which of the two agents has the smaller wealth, and take a percentage of the smaller wealth as the amount to be gained or lost in the transaction. For example, if the poorer agent has $100 and the percentage is 10%, this amount is $10.

Choose at random which agent gains and which loses. In our example, if the richer agent has $1000, then after the transaction there are two possibilities that can be chosen by the flip of a coin: either the richer agent now has $1010 and the poorer has $90, or the richer has $990 and the poorer has $110.

Repeat steps 2–4 many times and look at how the wealth is distributed among the agents.

Agents might represent individuals, corporations, investment funds, banks, or any other entity that can hold or exchange wealth. We will take “wealth” to include currency or anything that can be bought or sold with currency such as real estate, cars, art, stock, commodities, or even factories.